Liberation Day

The new realities of global trade. The first installment of our re-launched newsletter.

Tariffs are taxes on trade, and they are back in fashion. The term comes from the Italian tariffa—a mandated price—and as an economic tool they have been around since ancient Greece, where tariffs on grain were common. Britian has had them since at least the 1400s, when taxes on wool imports were used. The 2025 tariff surge comes from Washington DC, with President Donald Trump announcing them as part of “Liberation Day” on April 2nd. In the first edition of our new look newsletter—we have moved over to Substack—we look at how the new tariff rates are set, and what the impact might be.

Thanks for reading. Please subscribe for free to support our work.

What has happened? Did the UK end up with a good deal?

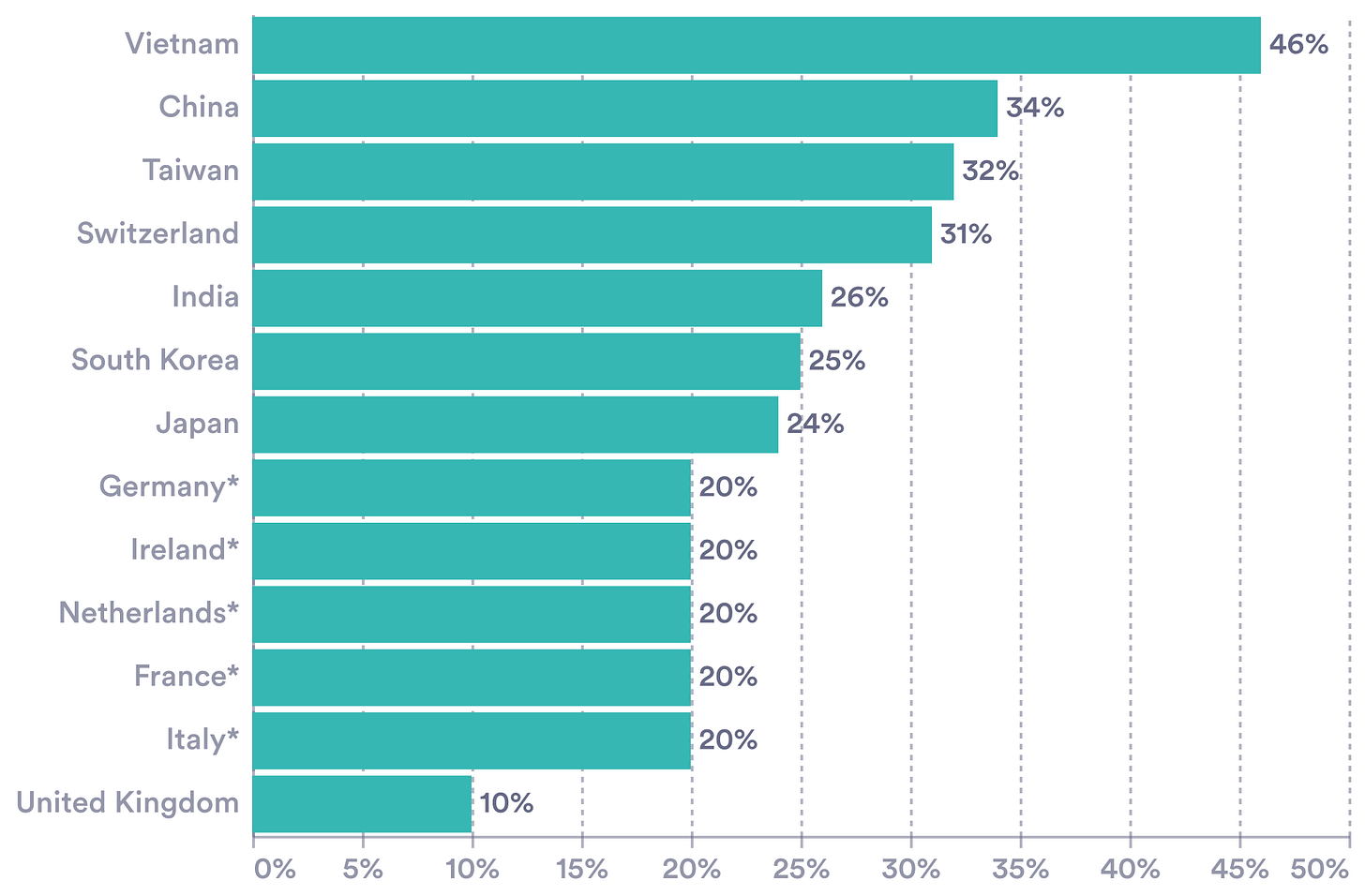

Britain is going to face a blanket 10% tariff under the new system. Car exports will pay more, with a special 25% tariff which aims to protect the US automotive industry. How does this compare to our trading partners and did our “special relationship” with America get us a good deal?

The new tariffs range from 50% for Lesotho (the deficit is driven by jeans and diamonds) down to 10% for a group of countries including the UK, Australia and Brazil. They are truly global in nature, with tiny nations including the Polynesian island of Tuvalu (which, surprisingly, exports computer monitors to the US) facing these new trade taxes. Here is a chart of the rates:

Chart 1: Reciprocal tariffs, major trading partners

Source: US Census Bureau, USTR

Note: Top 15 US trading partners, excluding Mexico and Canada. *EU countries subject to same tariff. Does not include existing tariffs.

The numbers have been set using a method that surprised economists. The expectation, with a ‘reciprocal’ tariff, was that it would be a tit-for-tat affair, with the US seeking to match or beat the tariffs that trade partners use: you charge me 15%, ill charge you 20%. Instead, the Office of the United States Trade Representative (USTR) took the US goods trade deficit with each country and divided it the US’ imports from that country. This gives a kind of “excess” of imports, as a percentage, the logic goes. The reciprocal tariffs are set at half of this number. Take Cambodia for example. In 2024, the US imported almost $13bn of goods from Cambodia, exporting less than $0.4bn. Putting the numbers into the formula gives an “excess” of almost 100%, and reciprocal tariff of 49%, one of the world’s highest. Others in South-East Asia have also been hit hard.

Economists have piled scorn on the approach (see Toby Nagel at FT Alphaville). Some have even suggested the policy was invented by Chat-GPT or another AI tool—these claims are reported on Brad Delong’s substack. Assuming—hoping—that it not the case, it is worth trying to reverse engineer the logic. Perhaps the idea ran like this: the US has large deficits with some countries that have low tariffs. Some of those countries make it hard for US exporters using local rules and regulations. These non-tariff barriers (NTBs) are proliferating and are hard to track. So rather than use other countries’ tariff policy as the baseline, let’s just use the trade deficit, since this is a result of both the restrictions we can see (tariffs) and those that are opaque (NTBs).

If this was the argument, then a lot of the facts in it are true (many countries do rely on local rules and regulations as a trade tool). But the policy response is problematic. To take just one example, a deficit with a trade partner might be based on their productivity: being relatively good, fast and cheap and making things. Global supply chains mean that all countries, including the US, import in order to assemble or finish goods and then export again—so you might have a deficit with one country (a supplier you buy intermediate goods from) that creates a larger surplus with another. In other words, deficit countries might be your domestic firms’ efficient suppliers, rather than “trade cheaters” in any sense. By hitting them the US may damage its own supply chains.

So, did the UK get a good deal? Well, yes and no. It is a good deal in the sense that we are on the lowest rate we could expect, 10%. But applying the new trade logic to Britain, there is an argument that our rate should really be 0%. The US calculations show that Britain doesn’t sell more to America than it buys, unlike China, the EU, and so many other countries. Rather that have a surplus, we are one of the few countries that has a goods deficit with the US. Britain’s weak trade, and what to do about it, is a topic we will come back to in future newsletters.

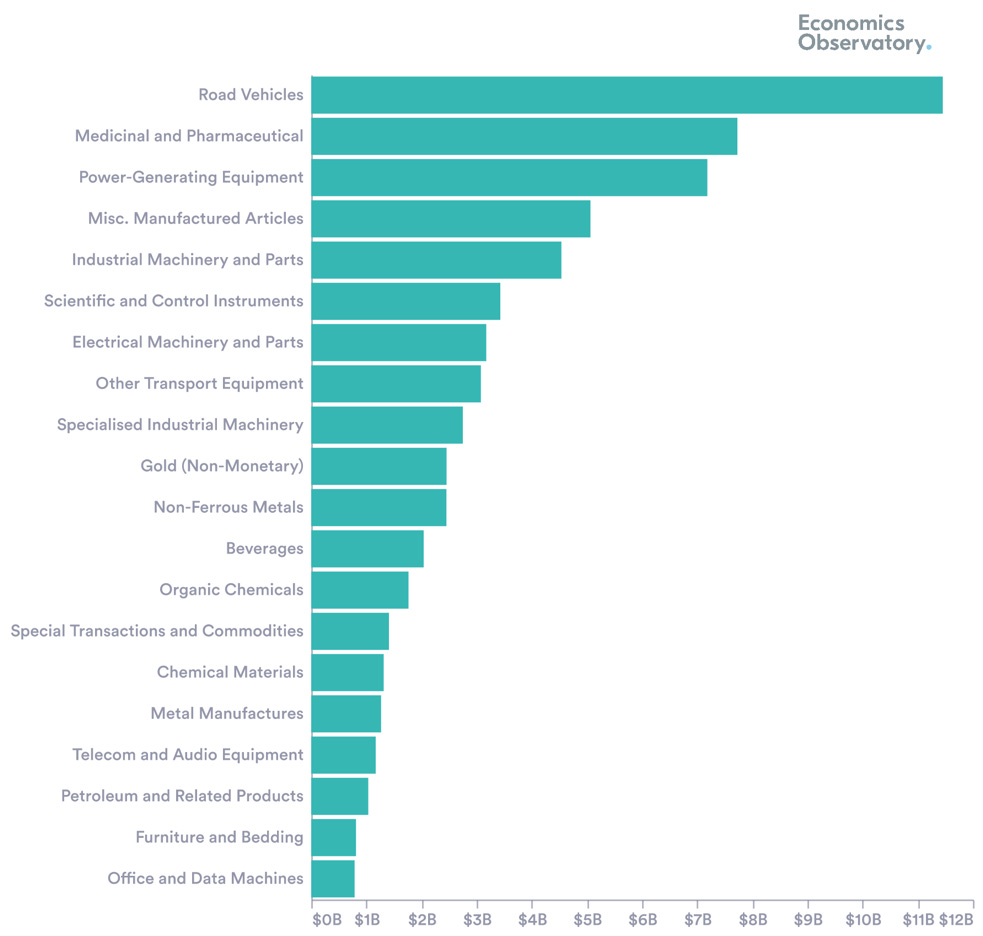

What does Britain’s trade with the US currently look like? Who will be hit hardest?

To answer this question, we looked at the UN’s Comtrade, the official source for trade between nations. A couple of charts from the Economics Observatory data unit are below. For a rule of thumb, the things to keep in mind over the next few months are cars, chemicals, and machinery.

Chart 2: Top UK exports to the US

Source: UN COMTRADE, SITC level 2

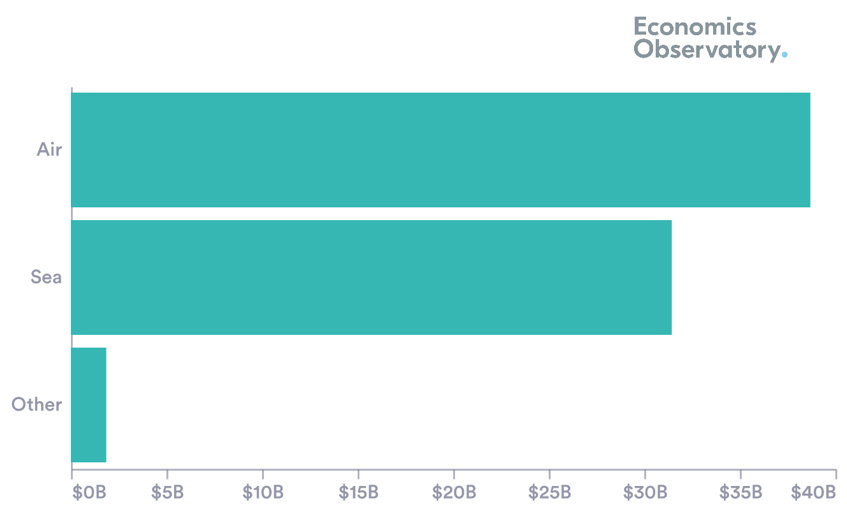

One thing I found interesting in the data is the importance of air freight for our trade with the US. This points to specialisation in smaller, higher value, industrial kit. Once Britain made steam trains in Glasgow that would be loaded onto boats on the Clyde (the vast cranes are still there) now we make high-tech machines—record players, for example—that can be loaded onto a plane. Much of this freight ends up at specialist airports that most of us will never visit, like Anchorage or Louisville.

Chart 3: UK exports to the US, by transport mode

Source: UN COMTRADE

Notes: Other includes unclassified flows, as well as low volume modes including ‘postal consignment’ and ‘self-propelled goods’.

Will prices rise in America?

Tariffs are not, as is sometimes assumed, paid by the exporting country. They are paid at the port, most often by a domestic importer. The key question in assessing tariff impact is whether the importers pass on those prices.

This need not be the case. Suppose an American firm is importing a British record player for $2000 (yes, they can be that expensive) and selling it for $2500, with a profit of $500. After Liberation Day, their cost, including the new tariff, is $2200. They have two options: keep prices the same and take a profit hit, or defend their profit margin and raise their prices. What do American firms tend to do?

One place to look are studies that examined Donald Trump’s 10-25% tariffs on Chinese goods, imposed in 2018. Many of these studies show that US firms defend their profits—i.e. tariff costs end up getting passed on. In particular, Steve Redding (Princeton) and co-authors found that by 2018 tariffs were costing the US customer $3.2 billion. A more hopeful analysis (for the US consumer, and UK firms) by Alberto Cavallo and colleagues found that consumer prices rose by much less than the tariff: a 10% tariff resulted in price rises of just 0.35%. There is no free lunch here though, as the importing firms’ costs rose: tariffs are hitting US firm’s profits.

Who is coming up with these ideas? Do we know what might happen next?

If the tariffs are so costly, economically, who is coming up with the ideas? One potential answer is the Council of Economic Advisers. Before taking up his role Stephen Miran, CEA chair, wrote a plan called “A Users Guide to Restructuring the Global Trading System”. It is a lengthy document with lots of radical ideas in it. It is not clear how much of this playbook is really being used, but suppose for a moment this is the blueprint being followed. If so, what we might see is:

Stage 1. Tariffs. Imposed for long enough to build bargaining position with key partners.

Stage 2. Currency depreciation. Co-ordinated action (in exchange for lower tariffs) to lower the price of the US dollar in order to boost US exports.

It is a radical proposal. There has been a lot of criticism (see, for example, Paul Krugman, here). But it is important to know that the second stage is the kind of thing has happened many times before – most recently with the Plaza (1985) and Louvre (1987) accords. These were steps taken under Ronald Regan to cheapen the dollar, again due to concerns over trade, at that time with Japan. If you believe that history echoes, then Mr Miran’s paper may be worth a read. On the history of monetary geopolitics more generally I recommend Barry Eichengreen’s, Globalising Capital, and The Summit by Ed Conway.

What will happen to UK prices? Will the Bank of England react?

We are going to see price volatility this year, with lots of people concerned about how the Bank of England might react. One scary study suggested the trade war would ramp up prices, with the Bank hiking its rate in response, leading to a deep recession.

A trade war is certainly not positive, but some of the most worrying stories are overdone, in my view. If a price change is mainly coming from a swing in US trade policy and/or the currency, the Bank of England may do very little. Its job is to target inflation, but it looks ahead to do this. If Britain were to face a jump in prices as trade wars escalate this kind of inflation is not a sign of a strong or overheating economy, so the double-whammy of this plus higher rates is unlikely. This was often the case following the GFC, which brought with it large depreciation, higher inflation and a weak growth.

Another way of putting this: if you have a mortgage and want to understand whether interest rates will rise or fall it is probably better, despite all the news on trade, to look at British wages. A big change here would be indicative of longer-run inflationary pressure, and more likely to trigger a reaction.

Chart 4 : USD-GBP exchange rate, 2005-present

Source: Bank of England

What does the public think?

America influences Britain, and we are just over a year away from vital elections in this country. What does the public, on each side of the Atlantic, think?

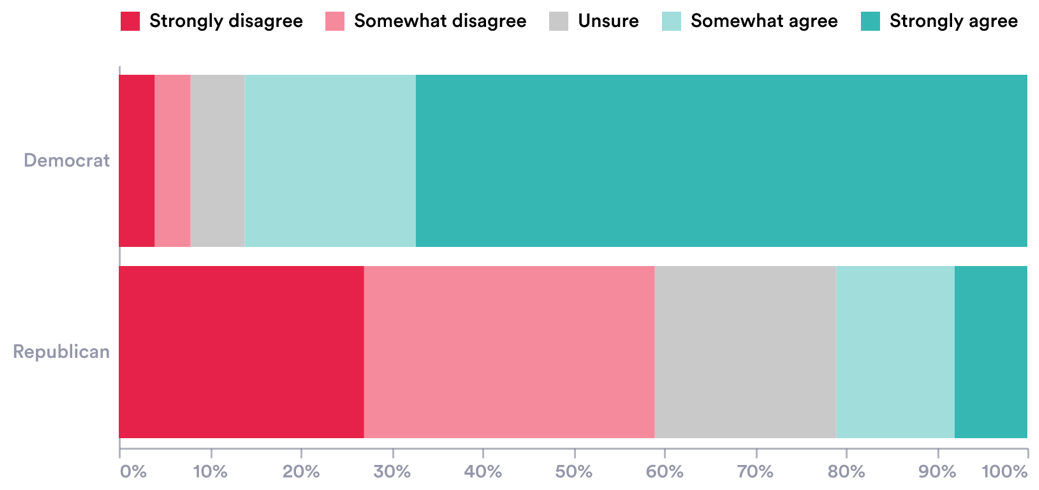

In the US, this is a partisan issue. A recent Ipsos poll of nearly 1,500 Americans found that almost 90% of Democrats believe the tariffs will do more harm than good—with 67% strongly agreeing. Republicans were much more positive, with less than 10% strongly agreeing. Republicans were also more while ambivalent: nearly 20% said they were unsure.

Chart 5: “US Tariffs will do more harm than good” agreement by partisanship.

Source: Ipsos/Reuters polling of 1,486 U.S. residents, March 31 to April 2, 2025

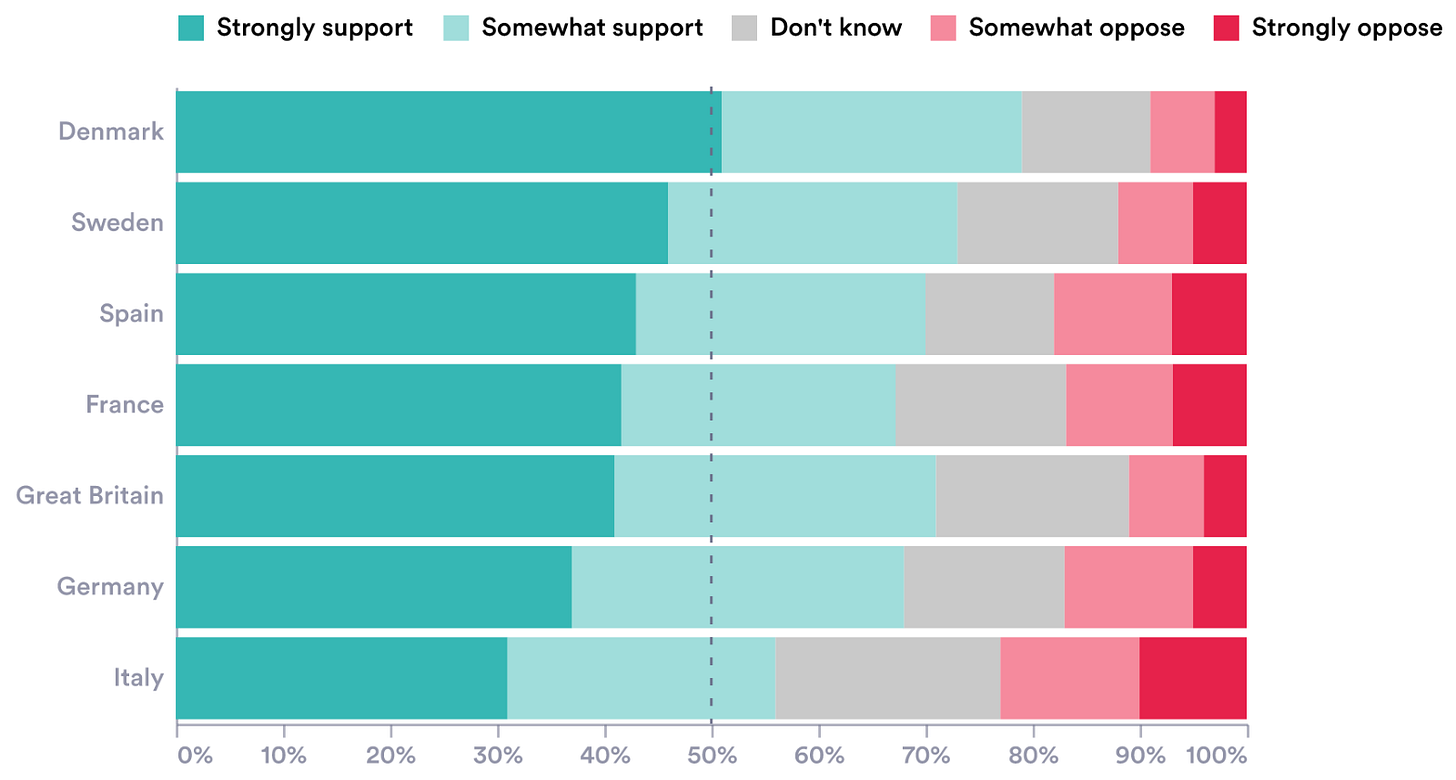

In Britain, there appears to be appetite for a retaliation. A recent YouGov poll found net support for retaliatory tariffs at 60% - 71% in favour, 11% against. Britons express less certainty, though, than other Europeans. Denmark, perhaps riled by President Trump’s approach to Greenland, is the country that with the strongest support for retaliation.

Chart 6 : “Do you support or oppose retaliatory tariffs on US goods?”

Source: YouGov poll of 9,452 adults in Denmark, Sweden, Spain, France, Great Britain, Germany, Italy

We will return to trade in coming weeks I am sure. Please let us know in the comments what you would like to see in the relaunched newsletter.

READING AND DATA SOURCES

Reading

Amiti, Mary, Stephen J. Redding, and David E. Weinstein. 2019. "The Impact of the 2018 Tariffs on Prices and Welfare." Journal of Economic Perspectives 33 (4): 187–210.

Cavallo, Alberto, Gita Gopinath, Brent Neiman, and Jenny Tang. 2021. "Tariff Pass-Through at the Border and at the Store: Evidence from US Trade Policy." American Economic Review: Insights 3 (1): 19–34.

Miran, Stephen. 2024. “A User’s Guide to Restructuring the Global Trading System.” Hudson Bay Capital, November.

Eichengreen, Barry (2019). “Globalizing Capital: A History of the International Monetary System - Third Edition”. Princeton University Press.

Conway, Edmund (2014). “The Summit: The Biggest Battle of the Second World War - fought behind closed doors” . Little, Brown. https://www.edmundconway.com/thesummit/

Data sources

Trade: https://comtradeplus.un.org

Exchange Rates: https://www.bankofengland.co.uk/boeapps/database/Rates.asp

US Current Account: https://www.bea.gov/data/intl-trade-investment/international-transactions

UK Current Account: https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/timeseries/aa6h/ukea

Should the G7 (and EU) now establish their own free trade area separate from the US?